|

The Review of the Market of Cheeses in the Republic of Belarus

Source: IRUE "National Center of Marketing and Price Study"

Cheese is a highly calorific and biologically high-grade foodstuff. Its food value is caused by high concentration of dairy fiber and fat and also by the presence of free amino acids, mineral salts, various microcells and vitamins necessary for human organism.

Its various marks are present at all price segments. It satisfies the most various tastes, is suitable for all age groups and is simultaneously a product both daily and intended for the celebratory table. Owing to these features it is possible to consider cheese as the indicator of changes in economy and well-being of the population.

Cheeses are received by curling of milk and the subsequent long processing of the received clot during which the moisture is removed. Processing is finished by the formation of cheese mass and the subsequent salting of the received cheeses.

Cheese gets its specific properties only after a long process of maturing in cheese cellars where are created conditions for accumulation of flavouring and aromatic substances in cheese mass.

Trade classification of cheeses is formed taking into account the basic processing methods of machining of milk and clot, and also the character of maturing of cheese, i.e. specific structure of the microorganisms which are taking part in maturing. By the way of curling of milk they distinguish rennet and sour-milk cheeses. The majority of cheeses produced by the industry belongs to rennet cheeses which are manufactured from milk by curling with adding of rennet enzyme.

During the manufacture of sour-milk cheeses milk is curtailed under the influence of dairy acid. The basic material for cheese manufacture in Belarus is the cow milk. Belarusian cheesemakers basically buy ferments in Russia at the Institute of butter industry and cheesemaking which was all-Union earlier. And milk coagulating enzymes are delivered by the Moscow factory of rennet enzymes. There is also a possibility to use European milk coagulating enzymes (from Denmark, Holland and other countries) - they are delivered to Belarus by various firms-intermediaries.

Rennet cheeses are subdivided into five groups, four of them are: firm cheeses ("Russian", "Dutch", "Swiss", etc.), semifirm ("Piquant", "Latvian", "Roquefort", etc.), soft ("Amateur", "Slavic", etc.) and brine («Suluguni», "Farmer", "Imeretinsky", "Brynza", "Adygean", etc.) -refer to to natural cheeses, and the fifth group - melted cheeses - to processed.

Cheesemaking in Belarus has deep historical roots. In the second half of XIX century in its territory existed nearby 200 cheese-making factories, using exclusively manual labour. They settled down basically in landowner manors. Cheeses were on sale not only in the home market, but also were exported to neighbouring countries, mainly to Poland, Ukraine, Russia.

In 1990 manufacture of cheeses in the country, according to Ministry of Agriculture and Food Production of the Republic of Belarus, made 65 thousand tons a year, including firm (most consumed) - 40 thousand tons.

Since 1991, total milk yields milk began to decrease, and the volume of manufacture of cheeses has accordingly decreased. Belarusian cheesemakers managed to leave the crisis only in 1996 when the manufacture growth up to 28,5 thousand tons was outlined.

Today the tendency of growth of manufacture of cheeses in the Republic of Belarus remains. So, in 2007 the volume of manufacture of cheeses and cottage cheese in comparison with the level of 2006 has increased on 5,7 %.

For 8 months of 2008 milk manufacture in agricultural organizations of Belarus has increased in comparison with the similar period of the last year on 8,8 %. Growth of purchases of milk in population economies has made for the specified period of 2008 4,4 % in comparison with the corresponding period of 2007.

The increase in manufacture of milk serving material for the cheesemaking, was an incitement for growth of its volumes. Release of fat cheeses for January-August of 2008 in comparison with the same period of 2007 has increased on 9,7 % up to 81,869 thousand tons, including firm and semifirm - on 10,2 % up to 74,458 thousand tons, melted cheese - on 5,2 % up to 4,66 thousand tons, brine - on 25,5 % up to 610 tons, other cheeses - on 19,5 % up to 190 tons. In this group only the release of soft cheeses was reduced on 3,5 % up to 1,951 thousand tons.

In the majority of the countries of the world with advanced volume of manufacture of dairy production on preparation of cheeses it is delivered from 35 to 50 % of all made milk. In the Republic of Belarus in 2007 26 % of annual manufacture of milk was directed on these purposes .

According to the Program of development of the meat and dairy industry for 2005-2010, confirmed by the decision of Council of Ministers of the Republic of Belarus from July, 15th, 2005 № 792 «About the programs of development of meat, dairy and sugar industry for 2005-2010», the basic directions of modernisation of the dairy branch taking into account increase of economic efficiency of work, escalating of manufacture of more profitable kinds of production, increase of export potential .

Along with other actions for modernisation by this Program are provided some measures directed on updating of operating and creation of additional capacities on manufacture of firm cheeses. Within the limits of the Program it is planned: in the Brest region to carry out re-equipment of departments on manufacture of firm cheeses with a gain of capacities on 7,5 tons in changeover, in Vitebsk region - reconstruction of departments on manufacture of firm cheeses with a gain of capacities on 5 tons in changeover, in the Grodno region - reequipment and building of departments on manufacture of firm cheeses with a gain of capacities on 16,2 tons in changeover, in the Minsk region - reequipment of departments on manufacture of firm cheeses with increase in capacity on 2,5 tons in changeover and in Minsk - reequipment of departments on manufacture of soft and processed cheeses.

Realisation of this projects will allow to provide increase in manufacture and export of firm cheeses on 15,6 thousand tons per year, to master new kinds of cheeses, to change the structure of processing of milk, having increased relative density of manufacture of firm cheeses up to 19%, and of fat cheeses up to 30% in the total amount of the processed milk.

The steady tendency to increase in manufacture of cheeses in the Republic of Belarus creates preconditions for growth of export deliveries.

Belarus basically exports cheese to Russia. Due to the presence of the big concentration of domestic cheesemakers the import of cheese is insignificant.

Belarusian export of cheeses and cottage cheese in 2002-2006 was characterised by decrease in rates of growth. In 2006 the deliveries of Belarusian production on foreign markets have reached the volume of 82,6 thousand tons for the sum of 215,3 mln. US dollars, that is on 39 % more in cost expression than in 2005. Thus in 2002-2006 export grew on the average per year on 49 % in cost and on 31 % in physical expression.

It is necessary to notice, that in 2006 Belarusian cheeses and cottage cheese were exported to the Russian Federation in volume of 82,5 thousand tons for the sum of 214,9 mln. US dollars. Besides, deliveries of Belarusian production were carried out on the markets of Ukraine (85 tons for the sum of 238 thousand US dollars), Moldova (36 tons for the sum of 101 thousand US dollars) and Armenia (4 tons for the sum of 13 thousand US dollars).

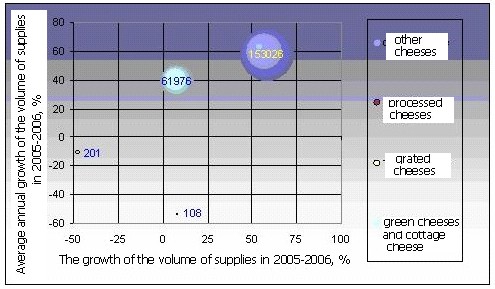

Structure of the Belarusian export of cheeses and cottage cheese by kinds in 2006 is reflected in the Fig. 1.

Fig. 1. Volumes of the Belarusian export of cheeses and cottage cheese in 2006, thousand US dollars

The Belarusian export of cheeses and cottage cheese in 2007 has grown relatively to 2006 on 56,8% in cost expression and on 19,9% - in physical, also has made 99,0 thousand tons for the sum of 337,6 mln. US dollars. Thus in January-May 2008 the deliveries to foreign markets have reached the volume of 35,6 thousand tons for the sum of 160,1 mln. US dollars, that concerning the similar period of 2007 makes 146,2 % in cost and 95,4 % in physical expression.

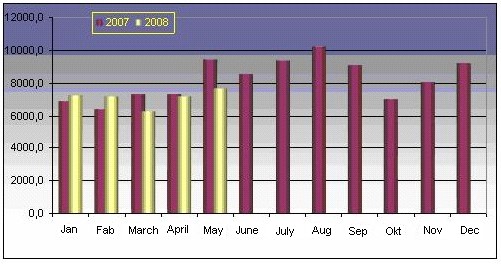

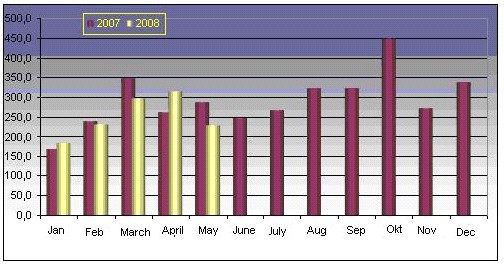

Fig. 2. Dynamics of export of the Republic of Belarus in January 2007 - May 2008 of cheeses and cottage cheese, tons

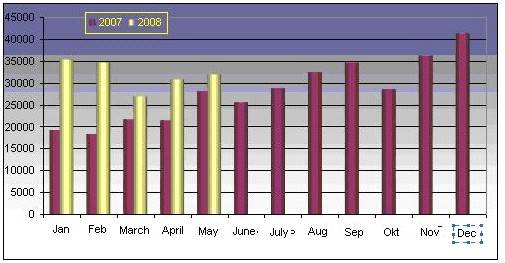

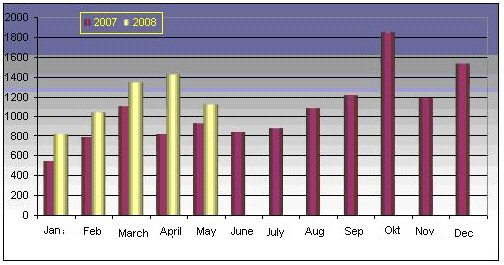

Fig. 3. Dynamics of export of the Republic of Belarus in January 2007 - May 2008 of cheeses and cottage cheese, thousand US dollars

It is necessary to notice, that in the considered period Belarusian cheeses and cottage cheese were exported basically on the market of the Russian Federation. In 2007 the deliveries in this direction have reached the volume of 98,6 thousand tons for the sum of 336,5 mln. US dollars in 2007 Thus, in January-May 2008 are exported 35,5 thousand tons of production for the sum of 159,5 mln. US dollars , that concerning the similar period in 2007 makes 146,3 % in cost expression and 98,4 % - in physical. Besides, the Republic of Belarus delivered cheese to Azerbaijan, Armenia, Italy, Canada, Moldova and the Ukraine.

Structure of the Belarusian export of cheeses and cottage cheese in 2007 by kinds is characterised by dissimilarity.

Deliveries to foreign markets of the Belarusian green cheeses and cottage cheese have reached in 2007 the volume of 31,3 thousand tons for the sum of 82,7 mln. US dollars. Within January 2008 Belarus exported 12,6 thousand tons of considered production for the sum of 45,4 mln. US dollars. Thus deliveries of the Belarusian cottage cheese with the maintenance of fat no more than 40 % have reached in 2007 the volume of 23,2 thousand tons for the sum of 55,5 mln. US dollars, in January-May 2008 - 9,2 thousand tons for the sum of 30,2 mln. US dollars.

External deliveries of grated cheeses of the Belarusian manufacture have made in 2007 532,8 tons for the sum of 2 457,0 thousand US dollars, in January-May 2008 - 354,0 tons for the sum of 1 704,1 thousand US dollars.

Export of the Republic of Belarus of processed cheeses has made in 2007 80,2 tons for the sum of 267,5 thousand US dollars, in January-May 2008 - 47,8 tons for the sum of 265,1 thousand US dollars.

60,1 thousand tons of other cheeses of the Belarusian manufacture for the sum of 229,6 mln. US dollars in 2007 were supplied on foreign markets, in January-May 2008 this figures made 22,7 thousand tons for the sum of 112,6 mln. US dollars.

Besides, export of the Republic of Belarus of cheeses and cottage cheese, identified by the code 0406000000 according to TN FEA of the Republic of Belarus, has made in 2007 7,0 thousand tons for the sum of 22,6 mln. US dollars, in January-May 2008 - 6,3 tons for the sum of 32,3 thousand US dollars.

Import of the Republic of Belarus of cheeses and cottage cheese in 2002-2006 is characterised by the substantial growth of rates of growth. If in 2002-2006 import of considered production grew on the average of 48 % per year in cost expression (on 43 % - in physical expression), in 2005-2006 it has increased on 124 %.

The basic volume of import of cheeses and cottage cheese on the Belarusian market falled in 2006 on deliveries from Russia (2,3 thousand tons for the sum of 6,3 mln. US dollars) and the Ukraine (1,0 thousand tons for the sum of 2,8 mln. US dollars).

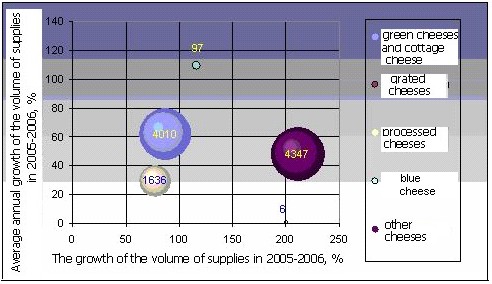

Fig. 4. Volumes of the Belarusian import of cheeses and cottage cheese in 2006, mln. US dollars

Import of the Republic of Belarus of cheeses and cottage cheese in 2007 has grown concerning 2006 on 26,7% in cost and was reduced on 2,8% in physical expression and has reached the volume of 3,5 thousand tons for the sum of 12,8 mln. US dollars. Thus in January-May 2008 on the Belarusian market are imported 1,3 thousand tons of cheeses and cottage cheese for the sum of 5,8 mln. US dollars, that in comparison with the similar period of 2007 makes 136,5 % in cost and 96,3 % in physical expression.

Fig. 5. Dynamics of import of the Republic of Belarus in January 2007 - May 2008 of cheeses and cottage cheese, tons

Fig. 6. Dynamics of import of the Republic of Belarus in January 2007 - May 2008 of cheeses and cottage cheese, thousand US dollars

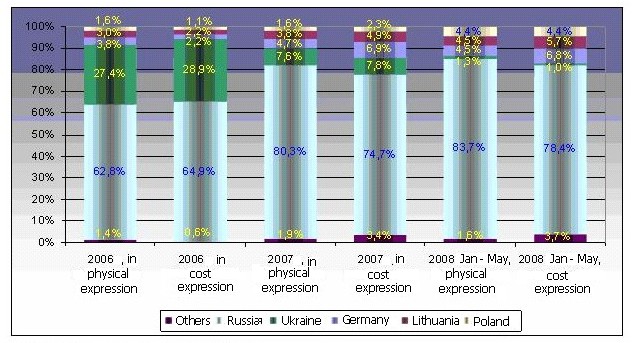

The leading position in the Belarusian market of cheeses and cottage cheese among the countries-suppliers belongs in the considered period to the Russian Federation. In 2007 import of Russian production has reached the volume of 2,8 thousand tons for the sum of 9,6 mln. US dollars, in January-May 2008 - 1,1 thousand tons for the sum of 4,5 mln. US dollars (concerning the similar period of 2007 - 137,5 % in cost and 96,8 % in physical expression).

Volumes of deliveries of cheeses and cottage cheese of the Ukrainian manufacture have considerably decreased in this period. Within 2007 Ukraine has supplied on the Belarus market of 269,0 tons for the sum of 1 005,8 thousand US dollars. Thus in January-May 2008 concerning the similar period of 2007 import has made 39,5 % in cost and 35,1 % in physical expression or 16,0 tons for the sum of 56,7 thousand US dollars.

The deliveries from Germany in 2007 have reached the volume of 166,0 tons for the sum of 889,5 thousand US dollars, in January-May 2008 - 57,2 tons for the sum of 391,2 thousand US dollars (concerning January 2007 - 143,5 % in cost and 97,7 % in physical expression).

High rates of growth are typical for the import of Lithuanian production. If in January-May 2007 the deliveries have reached the volume of 49,1 tons for the sum of 199,7 thousand US dollars, in January-May 2008 - 56,2 tons for the sum of 330,4 thousand US dollars. As a whole, within 2007 to Belarus were supplied 134,7 tons of considered production for the sum of 626,2 thousand US dollars.

The same tendency is observed in dynamics of deliveries of cheeses and cottage cheese from Poland. In 2007 import of Polish production has reached the volume of 58,1 tons for the sum of 288,9 thousand US dollars. Thus in January-May 2008 on the Belarusian market were supplied 55,0 tons for the sum of 255,1 thousand US dollars , that concerning the similar period of 2007 is more on 93,6% in cost and on 84,1% in physical expression.

At the same time, in the considered period the Republic of Belarus imported cheeses and cottage cheese from Austria, Denmark, Italy, the Netherlands, Syria, Finland, France and Sweden.

Fig. 7. Structure of import of the Republic of Belarus of cheeses and cottage cheese on the countries-suppliers

The basic volume of import of the considered production to the Republic of Belarus in 2007 has made the deliveries of green cheeses and cottage cheese - 2,0 thousand tons for the sum of 6,3 mln. US dollars. Thus in January-May 2008 on the Belarusian market were imported 0,9 thousand tons for the sum of 3,3 mln. US dollars .

It is necessary to note the big growth of the Belarusian import of grated cheeses. If in 2007 the deliveries of this production have reached the volume of 0,7 tons for the sum of 7,3 thousand US dollars, within the first five months of 2008 import has made 7,3 tons for the sum of 45,5 thousand US dollars.

The opposite tendency is characteristic in the considered period for the import of processed cheeses to Belarus. In 2007 import of this production made 535,6 tons for the sum of 2 064,0 thousand US dollars, volumes of deliveries in January-May 2008 have reached the values of 104,0 tons for the sum of 615,9 thousand US dollars.

The basic volume of import of blue cheeses is made by deliveries of other blue cheeses: in 2007 - 28,4 tons for the sum of 202,2 thousand US dollars, in January-May 2008 - 12,1 tons for the sum of 113,7 thousand US dollars. At the same time, to the Republic of Belarus were carried out deliveries of blue roquefort cheeses (accordingly 0,3 tons for the sum of 4,2 thousand US dollars and 0,1 tons for the sum of 2,3 thousand US dollars) and Gorgonsola (accordingly 2,0 tons for the sum of 19,2 thousand US dollars and 1,1 tons for the sum of 11,1 thousand US dollars).

At the norm of consumption recommended for human organism - 6,5 kg average cheese consumption per person in the Republic of Belarus makes a little more than 2 kg per year. In the majority of developed countries this indicator is makes 10-15 kg, and in such European countries as Italy and France reaches more than 20 kg. A principal cause of so essential difference is that while in Europe and the USA cheese consumption for last decade annually increases on 1,8-2 %, in Belarus it gradually decreases. The mentioned data testifies the essential reserves in cheese consumption in Belarus.

In 2008 the volume of the consumer market of the Republic of Belarus is predicted at the rate of 21 thousand tons, and by 2012 - 22,7 thousand tons. Increase in volumes of the consumer market on production in weight expression for 2008-2012 is predicted on 8,1 % that is much less than rates of growth across the Eastern Europe (22,34 %).

Under consumer characteristics they subdivide the Belarusian market of cheese into three groups: the basic, additional and elite.

The basic group (base assortment) includes the cheeses which are very demanded and more often bought. Cheeses of this kind have one general quality - their price is reasonable for Belarusian buyers. The basic share of consumption falls on four positions - "Rossiyskiy", "Poshehonskiy", "Kostromskoy", "Gollandskiy".

The second group are the cheeses of the average price range. Demand for them is below the demand for the basic cheeses, because they are more expensive. To them concern Swedish and Finnish ("Nature", «Oltermani»), German and Dutch («Maasdam» and "Tilsit"), etc. Rather recently Minsk dairy plant № 2 has mastered the release of the cheese "Stolichniy" (a prototype of well-known «Maasdam») which also can be carried to this group. The high price for these cheeses compels many consumers to carry them to products for a special case.

The elite group includes expensive French or Italian cheeses, and also separate grades from Spain, Switzerland, Holland. This are, as a rule, soft cheeses and cheeses with a mould. They are bought from time to time. As an example it is possible to mention the following marks of cheeses with a mould - "Roquefort" and «Dort Blue». They are considered as expensive and are concerned as a products for special cases. Demand for elite cheeses in regions is low (and is concentrated basically in large industrial centres), but steady.

The basic assortment of any shop make firm and processed cheeses.

With growth of incomes of the population the share of consumption of qualitative cheeses which are positioned in the average price segment, increases, as well as consumption of cheeses of premium class, thus the price in the grade choice is not always a defining factor.

Considering consumption of cheeses and the specificity of the Belarusian market, it is possible to notice, that today the buyer often goes to shop not simply to buy cheese, but to buy a concrete, preferable grade.

Now saturation of the market of firm and processed cheeses has led to toughening of competition among manufacturers. Struggle for the potential consumer only by improvement of quality or reduction of price does not give any more former results. Direct advertising support and also the use of various packaging and packing is effective. Exotic cheeses in small packing are rather attractive - they are cheap and give the chance to consumers to get acquainted with new tastes. One more way of advancement of cheese is positioning on marks: for example, «Savushkin product», «Yan Syrodel» etc.

The majority of consumers of cheese does not have accurately expressed preferable places of its purchase, therefore they use different trade enterprises: large shops (epicures, supermarkets), small grocery shops, the wholesale markets. As to the frequency of purchase of cheeses, here there are following laws. They more often buy firm cheeses(1-2 times per week), less often - processed and soft cheese (2-4 times per month), even more rarely - brynza (1-2 times per month) and absolutely rare - cheeses with a mould (once a month and less often).

Among firm cheeses the most popular are "Rossiyskiy", "Monastyrskiy", "Bukovinskiy", "Raubichskiy", "Voskresenskiy", "Kostromskoy", "Gollandskiy", "Poshehonskiy" as they have a reasonable price and correspond to tastes of the majority of the population. All this cheeses are firm rennet cheeses with a low temperature of the second heating. They are produced from the pasteurised cow milk with the use of bacterial ferment with the subsequent processing of the received clot, formation, pressing, maturing and intended for realisation and the direct use for food. From the soft cheeses the preference is given to such grades, as «Klinkoviy», "Adygheyskiy" and "Dessertniy". Manufacture of brine cheeses in Belarus has begun rather recently. At the same time such grades as «Suluguni» and "Brynza" are very demanded by consumers.The most popular of processed cheeses is "Kolbasniy", among portioned processed cheeses - "Yantar", "Kislomolochniy" and "Orshanskiy".

Owing to absence of sign distinctions in the cheeses presented on counters in shops, the consumer does not know, what to buy and stops the choice on the grade that he bought throughout the long period of time (for example, the cheese "Rossiyskiy"). And as though the manufacturer didn't tried to add flavouring filling agents and to improve the cheese smell, he will fail anyway, because he will not designate and will not allocate himself in the eyes of the consumer.

Key players, understanding, that it is necessary to attract the consumer and to interest him, to transfer from the category of amatuers, consuming production from time to time, in the adherent of the mark, come to conclusion about the necessity of creation of a brand - the trade mark with the developed image.

Today the problem consists not only in making production, but also in creating a competitive brand and to develop competently a strategy of its advancement in the market. The competition today is not in the industrial field, but in the communicational. And to build the communications successfully it is necessary to understand how the consumers behave.

The distinctions in preferences of processed and firm cheeses are not significant. Firm cheeses prefer 46,2 %, and processed 38,3 %. Besides, 15,5 % of buyers of cheese willingly consume firm and processed cheese grades.

At cheese purchase the basic defining criteria are the price (36,0 %); design and the packing kind (32,0 %). Except listed, buyers also pay attention to taste (16,0 %); piece weight (9,0 %), product periods of storage (7,0 %).

As the research shows, the defining factor after the price are the design and the packing kind.

Along with lower price characteristics positive distinctive qualities of the Belarusian cheeses is that they are made from natural products, and also as they arrive from the Belarusian manufacturer, they are considerably fresher than imported cheeses.

In the long term under condition of the use of the western technologies and presence of qualitative domestic raw materials our enterprises of this branch can press many import manufacturers from the market.

Growth of the volume of manufacture of cheeses essentially influences on the consumption volume that's why the production of local manufacturers obviously dominates in the majority of regions. Prevalence in assortment of cheeses of local manufacturers in many respects is explained by their lower price, the minimum transport expenses and long term of realisation.

The Belarusian market of cheese is perspective and dynamically developing. Demand on firm and processed cheeses is steady, manufacture volumes increase. The demand on elite grades starts to grow, that is a consequence of some increase of consumer ability of the population, especially in the capital.

However, by estimations of experts, the most perspective for regional sales are firm and processed cheeses with a long period of storage. While in Europe produce cheeses with the period of maturing from one year and more, the Belarusian enterprises produce basically early mature cheeses which are much more low under qualitative characteristics, besides term of their storage is limited.

The basic volume of cheeses in the Republic of Belarus is made by the enterprises subordinated to regional executive committees. For seven months of the current year their relative density in total amount of manufacture of fat cheeses has made 88,3%, the enterprises, subordinated to the city and district executive committees and local administrations - 10,4 %, legal bodies without departmental subordination - 1,2 % and concern "Belgospishcheprom" enterprises - 0,1 %.

The greatest quantity of cheese-making the enterprises of the Republic of Belarus is concentrated in the territory of Minsk region. Since Soviet Union times this area was the leading on manufacture volume as it has been completely provided by raw materials. One of the basic manufacturers of the Belarusian cheeses are also 7 enterprises of the Brest region taking the second place on technical capacities after the enterprises of the Minsk region. This situation is promoted by that fact, that in territory of the Brest region they produce milk, the most suitable for release of cheeses in the Republic of Belarus.

In the territory of Belarus there are about 40 enterprises which produce firm cheeses, 6 which produce processed cheeses. The majority of the Belarusian enterprises of the dairy industry produce soft cheeses. Production of these enterprises has found their buyer far outside of the republic.

|